When managing our finances, seeking proven money authorities is crucial. With the vast amount of online information, it can be challenging to discern who to trust. However, some individuals and organizations have established themselves as reliable sources of financial advice. In this blog post, we will explore some of the key figures and resources that people often look up to or follow for accurate financial guidance.

1. Financial Experts:

Financial experts are individuals who have extensive knowledge and experience in the field of finance. They provide valuable insights and advice based on their expertise. Some notable financial experts include:

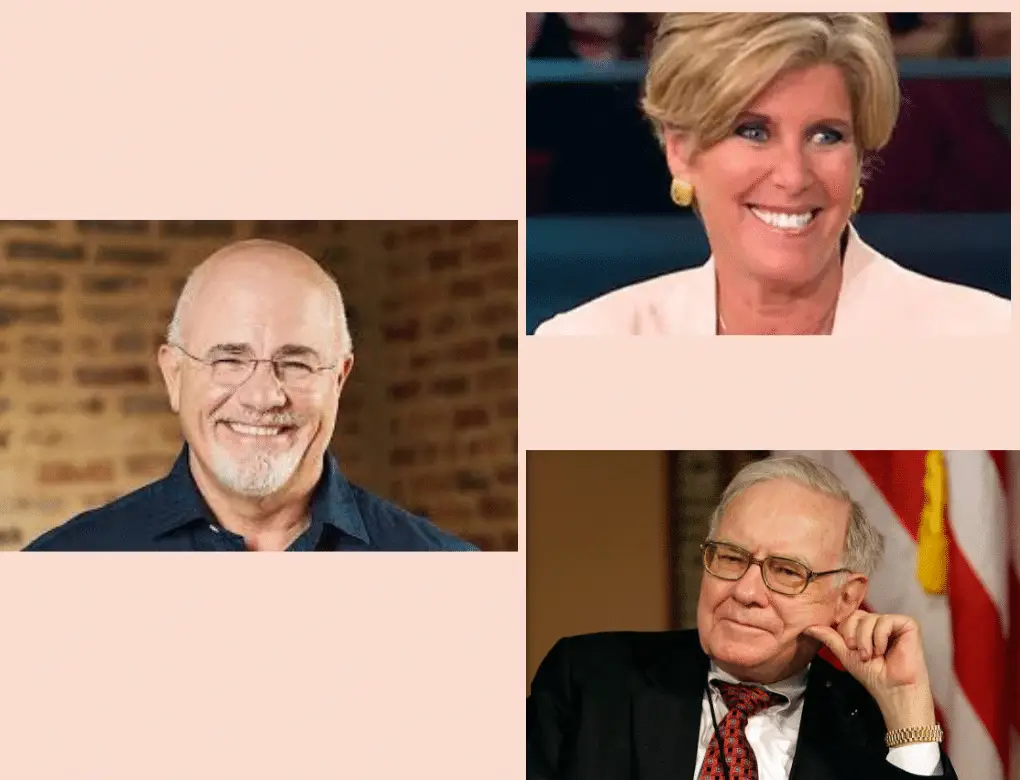

Warren Buffett, often referred to as the “Oracle of Omaha,” is one of the most successful investors in the world. His long-term investment strategies and value investing principles have made him a trusted figure in the financial world. Buffett’s annual letters to shareholders and interviews are highly regarded for their wisdom and practical advice.

b. Suze Orman:

Suze Orman is a renowned personal finance expert and bestselling author. She is known for her straightforward and practical financial planning and investing approach. Orman’s books, television shows, and podcasts offer valuable budgeting, debt management, and retirement planning advice.

c. Dave Ramsey:

Dave Ramsey is a well-known financial author, radio host, and motivational speaker. He is best known for his “Baby Steps” approach to financial freedom, which focuses on debt elimination and building wealth—Ramsey’s books, podcasts, and radio show guide budgeting, saving, and investing.

2. Financial Institutions:

Financial institutions, such as banks and investment firms, often have experts who provide financial advice to their clients. These institutions have access to extensive research and analysis, making them reliable sources of information. Some reputable financial institutions include:

a. Vanguard:

Vanguard is an investment management company known for its low-cost index funds and retirement planning services. They offer educational resources, tools, and personalized advice to help individuals make informed investment decisions.

b. Fidelity:

Fidelity Investments is a multinational financial services corporation that offers a wide range of investment products and retirement planning services. They provide access to research, educational materials, and financial advisors to help individuals manage their finances effectively.

Charles Schwab is a leading brokerage firm that offers investment services, retirement planning, and financial advice. They provide a wealth of educational resources, including articles, videos, and webinars, to help individuals navigate the complexities of personal finance.

3. Personal Finance Blogs and Websites:

Numerous personal finance blogs and websites offer valuable insights and advice on various financial topics. These platforms are often run by individuals who have personal experiences and expertise in managing their finances. Some popular personal finance blogs and websites include:

The Penny Hoarder is a personal finance website that provides practical tips and advice on saving money, making extra income, and managing debt. They cover various topics, including budgeting, frugal living, and side hustles.

b. NerdWallet:

NerdWallet is a popular financial website that offers unbiased advice and reviews on credit cards, banking, investing, and insurance. They provide tools and calculators to help individuals make informed financial decisions.

Mr. Money Mustache is a personal finance blog that promotes financial independence and early retirement. The blog’s author, Pete Adeney, shares his experiences and strategies for achieving financial freedom through frugal living and smart investing.

Conclusion:

When seeking proven money authorities, it is essential to rely on reputable sources with a track record of providing reliable information. Financial experts, reputable financial institutions, and trustworthy personal finance blogs and websites are all valuable resources to consider. Remember to evaluate the advice based on your financial goals and circumstances, and always consult a professional before making any major financial decisions.