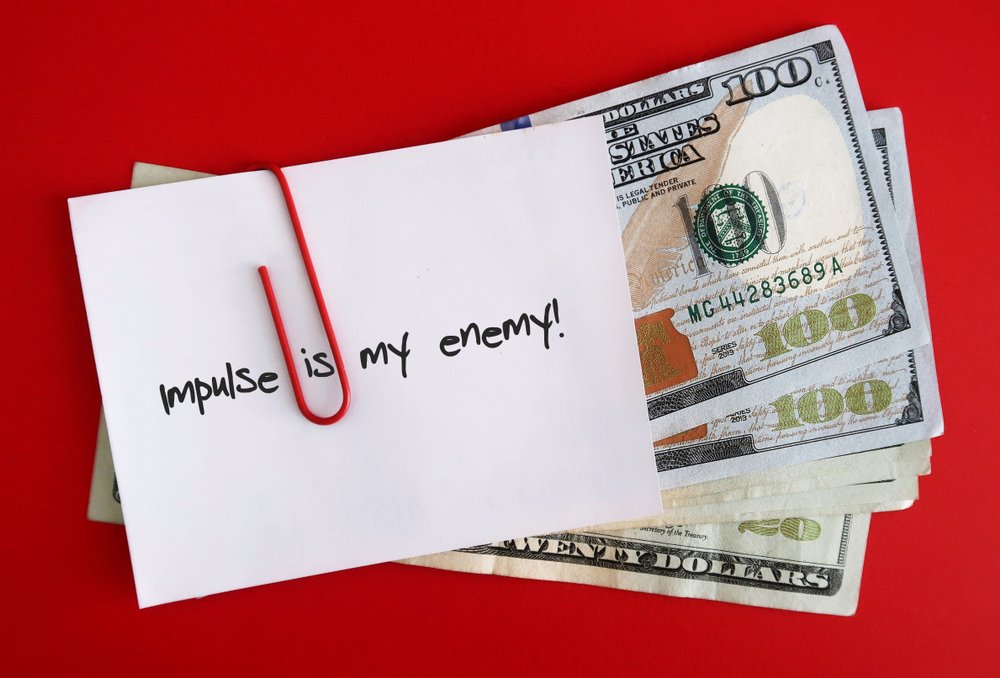

In today’s fast-paced world, it’s easy to fall into the trap of impulse spending. It can be a quick decision, a swipe of a card, and the money is gone just like that. While these decisions offer immediate gratification, they can be a significant roadblock to financial stability and wealth creation. By adopting better strategies to manage your spending habits, you can curb impulse purchases and move closer to achieving long-term financial goals. Here’s how you can do just that:

Understanding Impulse Spending

Impulse spending occurs when you make unplanned purchases, often driven by emotional responses. Advertisers and retailers are experts at triggering this behavior by creating an enticing shopping environment, both online and offline. Recognizing the signs of impulse buying is the first step towards managing it effectively.

Signs of Impulse Spending:

- Purchases made due to stress or emotional highs/lows.

- Buying items simply because they’re on sale.

- Frequent purchases that are not aligned with your current needs or budget.

Strategies to Curb Impulse Spending

Create a Budget and Stick to It A budget is a blueprint that reflects your income, expenses, savings, and investment goals. By setting clear financial boundaries, you can make more informed purchasing decisions.

Steps to Create a Budget:

- Track your income and categorize your expenses.

- Identify the areas where you can cut down on spending.

- Allocate a fixed amount for discretionary spending.

- Regularly review and update your budget.

- Prioritize Needs Over Wants Before making any purchase, ask yourself if you genuinely need the item or if it’s simply a want. Creating a list of essential expenses can help you differentiate between the two and focus on what truly matters.

- Implement the 24-Hour Rule For non-essential purchases, practice waiting at least 24 hours before making a decision. This pause often provides the clarity needed to determine if the purchase is worth it or merely an impulsive desire.

- Unsubscribe from Marketing Emails Retailers often send frequent promotional emails enticing you with sales and discounts. By unsubscribing from these newsletters, you can reduce the temptation to buy things you don’t need.

- Use Cash Instead of Credit Cards Research shows that people spend less when using cash than credit cards. The physical act of parting with money can make you more conscious of your spending habits.

- Foster Mindful Spending Habits Mindfulness involves being present and fully engaged with what you’re doing. Apply this to your spending by asking critical questions before every purchase:

- Why am I buying this?

- How does this align with my financial goals?

- What will this purchase mean for my budget?

Concentrating on Creating Wealth

Once you’ve managed to curb impulse spending, the next step is to focus on building wealth. Creating wealth involves saving and growing money through investment strategies that align with your risk tolerance and financial goals.

- Establish an Emergency Fund An emergency fund acts as a financial safety net, allowing you to cover unforeseen expenses without derailing your financial plan. Aim to save between three to six months’ worth of living expenses.

- Automate Savings and Investments Set up automatic transfers from your checking account to savings and investment accounts. This “pay yourself first” strategy ensures consistent savings contributions.

- Explore Diverse Investment Options Investing is a powerful tool for wealth creation. Diversify your portfolio to mitigate risk, considering options such as:

- Stocks: Offers potential for significant growth and is suitable for those with a higher risk tolerance.

- Bonds: Generally considered safer than stocks, providing steady income with lower risk.

- Mutual Funds/ETFs: These offer diversification within a single investment.

- Real Estate: A tangible asset that can provide passive income.

- Educate Yourself on Financial Literacy Knowledge is your greatest asset to wealth creation. Develop your understanding of personal finance through books, webinars, financial blogs, or consulting a financial advisor.

- Set Specific Financial Goals Identifying short-term and long-term financial goals gives your savings and investment efforts purpose. These could range from saving for a vacation, purchasing a home, retiring early, or starting a business.

- Regularly Review Your Financial Plan Life; your financial needs and goals are dynamic. At least annually, review your financial plan to ensure it remains aligned with your objectives and adjust as necessary.

Conclusion

Managing your finances effectively is a journey that begins with curbing impulse spending and progresses toward intentional wealth creation. It involves discipline, strategic planning, and a proactive attitude toward learning and adapting. Remember, every small step toward changing your spending habits today can profoundly impact your financial stability in the future. By implementing these strategies, you won’t just have more control over your finances—you’ll be well on your way to building enduring wealth and achieving financial independence.